Excel Bridging for MTD VAT

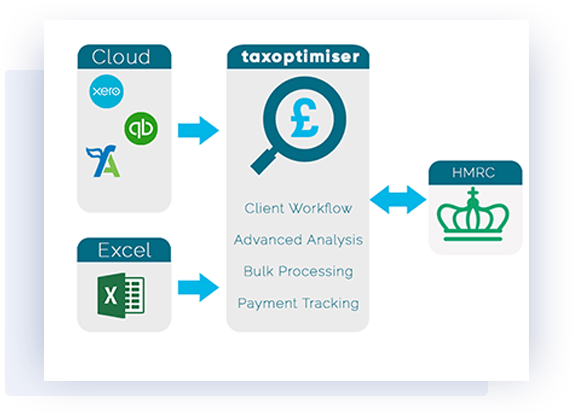

We provide a free* bridging tool for MTD VAT for businesses and accountants

-

Whether you are a VAT Group or your accounting solution that doesn't support HMRC MTD VAT. We provide a tool to submit returns, view payment and whether your clients have any liabilities.

-

*free for individual organisations for the first year see pricing for more details

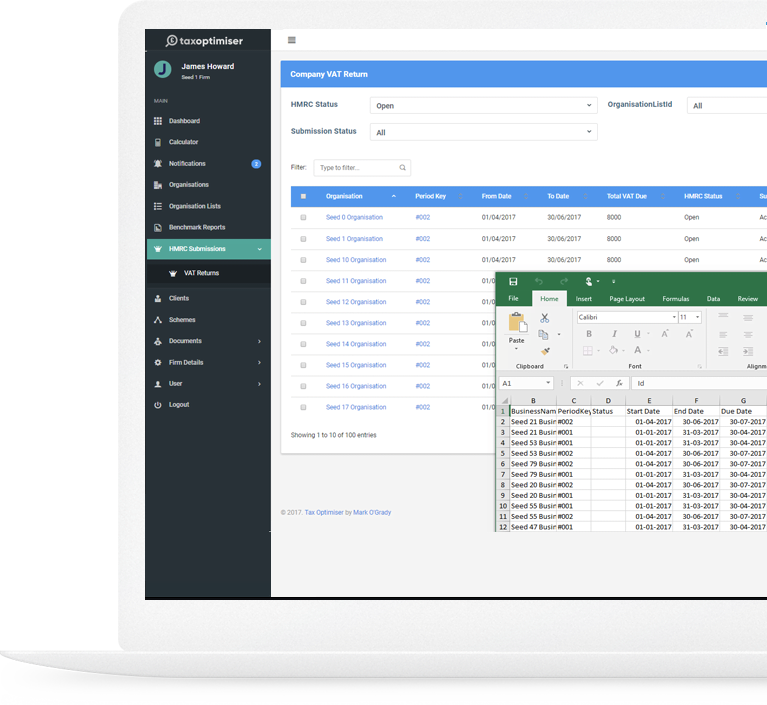

We provide a variety of function to submit VAT returns

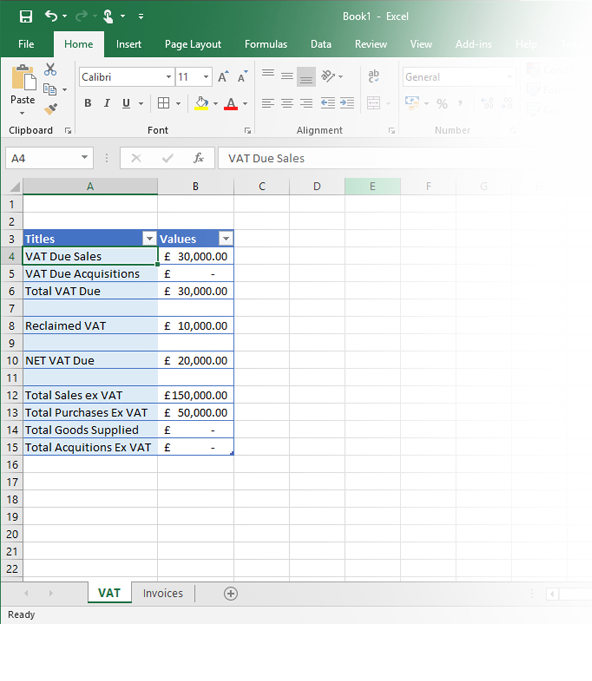

If you need are using a bespoke system, submitting on behalf of a VAT group or you are using software that does not support MTD then our excel import will solve your problem.

Custom validation

We provide a collection of rules to double check whether there could be an issue. For example the sales nominal does not match the return value or whether the previous years return for the same period is within 10%

Configure the sheet and cells to collect the data from

Select the VAT obligation in the software

Upload the excel file

Send the VAT Return

Pricing

Organisation

Basic / Free for the first year

Pricing is for the VAT or ITSA module only. Sign up for free today

No credit card required

Accountants

We also offer the option to white label tax optimiser with your firms branding and custom website address

Basic 10 tier

Pricing is for the VAT/ITSA module only. for up to 10 organisations or individuals

Basic 50 tier

Pricing is for the VAT/ITSA module only. for up to 50 organisations/individuals

Corporation Tax and Accounts Production

£10 per organisation for both the corporation tax and end of year accounts submissions

Making Tax Digital - All you need to know about VAT returns

Here is a video on our thoughts about Making Tax Digital VAT Returns and how to be as productive as possible